Often, the reason is that the facility believes that the resident’s condition has deteriorated to the point where it can no longer provide all the services that he or she needs. [Read more…]

508.757.3800

Have a question? Give us a call.

Schedule Your Consultation

Would you like to meet with us?

by Kristina

Often, the reason is that the facility believes that the resident’s condition has deteriorated to the point where it can no longer provide all the services that he or she needs. [Read more…]

by Kristina

Earlier this year, the government agreed to settle a class action lawsuit over this issue. That settlement has now been approved by a federal court – and what’s more, the settlement has been made retroactive to January 18, 2011, so if you were denied coverage for services after that date, you might be able to go back and re-apply for coverage. [Read more…]

by Kristina

by Kristina

Under Medicare Part B, which pays for doctor visits, once your annual deductible is met, Medicare pays 80 percent of what it considers a “reasonable charge” for the item or service. You’re responsible for the other 20 percent. [Read more…]

by Kristina

by Kristina

If you, or a loved one, depend on Medicare for ongoing care of a chronic or degenerative disease, you may be familiar with the Medicare Improvement Standard.

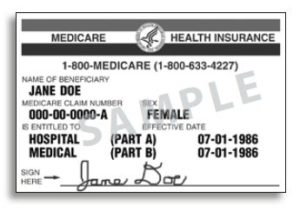

Medicare is health national insurance for people over age 65, the disabled, or those with end stage renal disease. For decades, the Medicare Improvement Standard meant that coverage for physical, occupational and speech therapy and some inpatient skilled nursing was denied by contractors processing claims for many people who had reached a plateau in their treatment, that is to say, for those who were not improving.

Medicare is supposed to pay for reasonable treatment as long as a doctor has prescribed it. For in-home care, a doctor must have certified that you are, in fact, homebound and have prescribed treatment that only a skilled practitioner can provide. This “skilled practitioner rule” keeps Medicare from paying for assistance with everyday activities like bathing and dressing.

Consider the case of Glenda, she is 76 and rendered disabled by diabetes. She is both blind and has suffered amputation of a leg and several toes. She was the lead plaintiff in the case that led to the settlement, and under the Medicare Improvement Standard, had been denied coverage of the skilled care she needed due to the fact that her condition was chronic and did not improve. This unofficial policy has been frustrating to many. It is often painfully obvious that those suffering chronic or degenerative diseases will not and cannot improve. But, the kind of skilled care covered by the Medicare Improvement Standard settlement can stabilize or slow the progression of such diseases. These patients can now prevent painful and costly complications.

The Medicare Improvement Standard settlement requires the Centers for Medicare and Medicaid Services to clarify to their contractors that home and nursing home therapy and nursing services for Medicare beneficiaries are not dependent “on the presence or absence of a beneficiary’s potential for improvement from the therapy (and nursing care), but rather on the beneficiary’s need for skilled care.” This language also pertains to outpatient therapy services. This clarified policy is know as the “maintenance coverage standard.”

The Center for Medicare Advocacy, co-counsel for the Plaintiffs, stresses that the new standard applies now, and that Medicare patients denied coverage under the old “medicare improvement standard” should advocate for themselves and appeal those denials.

It is important to remember that this Medicare Improvement Standard settlement does not affect the need for long-term care planning. Without careful planning you may still have to pay for years in a nursing home when you can no longer handle basic tasks of daily living and staying in your home is no longer practical.

If you, or a loved one, would like more information about long-term care planning contact us. Proficient in Estate Planning, Elder Law and Long-Term Care/Medicaid (MassHealth) Planning, Attorney Kristina Vickstrom can help you understand your rights and any remedies that may be available to you.

by Kristina

In a major change, the federal government has agreed to provide seniors who have chronic illnesses and disabilities with Medicare coverage for many services … even if those services will simply maintain the person’s present health status and aren’t likely to improve their condition.

This is very important news for people who have diabetes, heart disease, Alzheimer’s disease, multiple sclerosis, Parkinson’s disease, Lou Gehrig’s disease, arthritis, or the effects of a stroke, among other medical conditions.

Soon, these seniors may be able to obtain Medicare coverage for care in a skilled nursing facility, as well as home health care and outpatient therapy.

For decades, Medicare had a “rule of thumb” that coverage for these services was available only if they were likely to lead to an improvement in the patient’s condition. This resulted in many people with chronic illnesses being unable to obtain coverage for treatments that were critical to maintaining their health, but that didn’t promise a cure or improvement.

According to the government, treatments that weren’t likely to lead to improvement were considered “custodial care,” which Medicare doesn’t cover.

But in January 2011, a group of seniors and some elder advocacy groups brought a nationwide class action lawsuit against the government. They argued that this policy violated their rights, because the “rule of thumb” against covering such services never actually appeared anywhere in the Medicare laws.

The government tried to have the case thrown out, but recently a federal judge rejected that request and allowed it to proceed. Shortly afterward, the government agreed to settle the case by expanding Medicare coverage.

The settlement is being reviewed by the court, and it’s still unclear exactly when the policy change will go into effect. It’s also unclear whether the change will apply just to future claims or to claims going all the way back to January 2011.

Under the terms of the settlement, patients who have “plateaued” in their treatment but still need the assistance of a skilled professional such as a nurse or therapist will be eligible for all of Medicare’s standard benefits. Seniors who are enrolled in Part A, which covers hospitalizations, will be eligible for up to 100 days in a skilled nursing facility (as long as it follows a three-day hospitalization), as well as up to 100 home visits following a hospitalization. Seniors who are enrolled in Part B, which covers doctor visits and other outpatient services, are eligible for potentially unlimited home visits.

It’s not completely clear to what extent the new policy will increase Medicare coverage for dementia. Many seniors with dementia simply need custodial care – unskilled help with routine activities of daily living such as eating, dressing, and bathing – and this kind of unskilled care wouldn’t be covered under the settlement.

However, if the services of a skilled professional might delay the progress of dementia, then those services might be covered. For example, Medicare might now cover occupational therapists who specialize in helping dementia sufferers.

In addition, Medicare might also begin covering speech therapists who teach stroke and Parkinson’s patients how to regain their communications skills. If you’d like to discuss all the ways Medicare is available to cover your or a loved one’s health issues, contact Attorney Kristina Vickstrom today at 508-757-3800.

[photo credit: Wikimedia.org]

by Kristina

A three-day hospitalization often serves as a gateway for a senior citizen’s transition into a skilled care facility. When the patient is discharged to a skilled care facility for occupational, physical, or speech therapy, the patient’s health insurance (Medicare) will continue to finance treatment for up to 100 days per stay (as long as the person continues to benefit from rehab). Medicare coverage ultimately ends, and when it does, the patient must pay from income, savings, long-term care insurance, Medicaid, or a combination of these resources. [Read more…]

Have a question? Give us a call.

508.757.3800

Want to leave us a review?

Review Vickstrom Law